The Ando Europe FunD

Regulated Golden Visa Fund

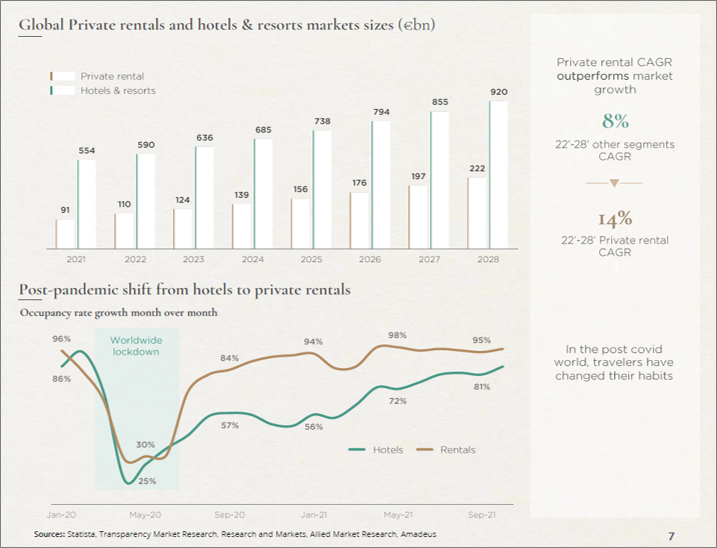

Invest in the fastest-growing hospitality segment: private rental

The Ando Europe Fund, Golden Visa eligible, invests in the hospitality business with a special focus in serviced apartments. The fund will invest in the hospitality business with a special focus on the management of short-term stay apartments, based on the successful business and proven track record of Ando Living Group.

– Serving prime or up and coming locations including but not limited to hotels, apart-hotels, serviced-apartments, food and entertainment businesses.

– Geographical focus on Portugal, mainly Lisbon, as well as other European cities such as Madrid, Paris, London and Athens with excellent tourism potential.

– Investments in Fit -out , Furniture, Fixtures & Equipment and Operating Supplies & Equipment secured by long-term management contracts and operating companies with proven track record.

Advised by

Managed by

A DIVERSIFIED INVESTMENT STRATEGY

HOSPITALITY +/- 60%

(Ando Living serviced apartments)

– Furniture, Fixtures & Equipment.

– OpEx.

– Rent advance payments.

– Acquisition of Operation Companies.

– Backed by long-term contracts with Ando Living operations.

– Pay back in 1 to 3 years.

Up to 8% per annum (debt structure).

FOOD & ENTERTAINMENT +/- 40%

(Ando Living Clubhouses)

– Furniture, Fixtures & Equipment.

– OpEx.

– Rent advance payments.

– Backed by long-term contracts, in partnership with leading operators.

– Pay back in 3 to 5 years.

Up to 8% per annum (debt structure)

INVEST IN THE FASTEST GROWING HOSPITALITY SEGMENT:

PRIVATE RENTAL

Private rental is the most promising segment in travel accommodation.

Service Apartments is the future of private rental

THE ANDO EUROPE FUND TERMS

(1) Comissão do Mercado de Valores Mobiliários.

(2) For Golden Visa investor minimum investment €500.000.

(3) Target Annual Return takes into account the potential annual distributions plus capital gains at exit, net of Fees & Expenses.

(4) Calculated for a regular year with a fund size of €50 million at 1.80%. Includes fund management fees and expenses, including legal and regulatory fees.

PORTUGAL GOLDEN VISA ELIGIBILITY & PROCESS

The Ando Europe Fund qualifies for the Portuguese Golden Visa program, as a fully non-real estate collective investment fund established under Portuguese law.

These funds have a minimum maturity of 5 years at the time of investment, with at least 60% of the invested value directed towards commercial companies based in Portugal.

Minimum capital transfer required: €500,000

THE PORTUGAL GOLDEN VISA BENEFITS

– The only European program with a short-stay requirement to apply for the passport.

– Requires only 14 days minimum stay every 2 years.

– Enables applying for citizenship 5 years from the application date with Portuguese A2-level.

– Provides the right to travel without a visa throughout the European Union (26 countries in the Schengen area).

– Includes family members, spouses and dependents through “Family Reunification”.

– Grants the right to live, work and study in Portugal, and after the citizenship is processed, in the whole Europe.

– Enables investment in a stable economy.

THE PORTUGAL GOLDEN VISA APPLICATION REQUIREMENTS

– Be over 18 years old.

– Be a non-EU/Swiss national.

– Make a total investment of €500.000 into Golden Visa eligible funds.

– Have a clean criminal record.

– Provide birth and marriage certificates of family members.

– Conduct all investment transactions through a Portuguese bank account.

HOW DOES RESIDENCY & CITIZENSHIP WORK?

YEAR 0

Kick Off for Golden Visa Application.

After completing your investment, your legal advisor will finalize your application through AIMA online portal. This officially starts the 5-year countdown for your passport application

YEAR 2/3

Renew Your Golden Visa.

As you reach the end of your 5-year period after the first application, you have the following options:

– Apply for citizenship.

– Apply for Permanent Residency.

– Keep renewing the Golden Visa (by keeping the investment)

YEAR 5

As you reach the end of your 5-year period after the first application, you have the following options:

– Apply for citizenship.

– Apply for Permanent Residency.

– Keep renewing the Golden Visa (by keeping the investment)

The group behind Ando Living

Behind Ando Living is the Ando Living Group, an existing successful and profitable hospitality group specialized in serviced apartments. The Group is currently the market leader in Portugal, having raised previously €67.5 million equity for its expansion, through Prima Europe fund.

Our real estate development and investment management company

- €1.8bn Gross Development Value

- 38 projects 1 M sqm of owned, managed, and developed properties

- 5 funds advised in Portugal, representing €200M in equity

- Trusted by 600+ investors from 40+ countries

- 6 international awards

Our premium design and hospitality brand

Ando Living is the first lifestyle serviced apartment brand in Europe. We design all the apartments with Ando Living’s signature branding and design elements.

- Premium, welcoming and soulful design

- High-end equipment and furniture

- Impeccable workmanship and finishing

- Over 90% guest satisfaction

Our property management company

- €600M under exclusive management

- 1,500+ apartments under management

- 500,000+ guests welcomed

- 175,000+ bookings managed with cutting-edge technology

- €85M generated for owners through our yield management system

- €50M estimated gross booking value in 2024

Disclaimer

This document is intended for INFORMATION PURPOSES ONLY and CONFIDENTIAL. It does not constitute any efforts to actively solicit any investors or introduce any investment ideas.

The information contained/available herein is confidential, and by accepting this Presentation, the recipient agrees not to copy, distribute, discuss, reproduce or pass (in whole or in part) to another person, otherwise disclose this Presentation or the contents hereof (including the potential investment opportunity described) or any other related information provided by STAG Fund Management, SCR, S.A. (the “Fund Manager”) or by its agents to any person other than employees of the recipient evaluating this potential investment prospect on the recipient’s behalf without the prior written consent of the Fund Manager.

This document is intended to provide information only and is not intended to be construed as a solicitation for the sale of any particular investment. It does not represent investment advice or personal recommendation to any person.

Changes in exchange rates may have an adverse effect on the value of and income from investments. The value of investments and their income can go down as well as up and could rise or fall dramatically. The Disclosing Party cannot be held responsible in such cases. Investors may not get back the full amount invested. If you have any doubt about the suitability of investments for you, you should consult your financial advisor.

The information contained herein employs proprietary projections of expected returns as well as estimates of their future volatility. The relative relationships and forecasts contained herein are based upon proprietary research and are developed through analysis of historical data and capital markets theory, for all due effects being indicative. These estimates have certain inherent limitations, and unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs that may suffer variation. References to future returns are not assurances or even estimates of actual returns a client portfolio may achieve.

The forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

While the information contained herein has been obtained from various sources, but not guaranteed, to be reliable, the Fund Manager does not represent that it is accurate or complete and it should not be relied upon as such. No person has been authorized to give any information or make any representation or warranty regarding the subject matter hereof, either express or implied, and, if given or made in this Presentation, in other materials, verbally or by any other means, such information, representation or warranty cannot and should not be relied upon nor is any representation or warranty made as to the accuracy, content, suitability or completeness of the information, analysis or conclusions or any information furnished in connection herewith contained in this Presentation and it is not to be relied upon as a substitute for independent review of the underlying documents, available due diligence information and such other information as prospective investors may deem appropriate or prudent to review.

This Presentation is solely for information purposes; under no circumstances is it to be used or considered as an offer to sell, or a solicitation of an offer to buy, any security or other interest in the Fund. Nothing contained herein shall be deemed to be binding against, or to create any obligations, rights, or commitment on the part of any interested counterparty and the Fund Manager.

The Fund Manager reserves the right, in its sole and absolute discretion, with or without notice, to at any time alter or terminate the terms or conditions of this Presentation and the Fund and/or to alter or terminate the terms relating to potential investments described herein.

Potential investors are not to construe this Presentation as investment, legal, or tax advice, and the Fund does not assume or owe any duties to recipients hereof, nor shall it have any liability to recipients for the contents hereof. Prior to fulfilling any potential investment, potential investors should, at their own expense, consult with their own legal, investment, accounting, regulatory, tax, and other advisors to determine the consequences of the potential investment opportunity described herein and to conduct an independent evaluation of such potential investment opportunity.

There is no guarantee for the investors in the preservation of the invested capital, or in relation to the profitability of its investment, therefore existing a risk of total loss of the investment; the investment in this Fund is subject to the risk of changes in the prices of the assets comprised in the respective portfolio; the investment in this Fund is indirectly exposed to the risk of political instability or changes in tax conditions; reimbursement of participation units shall occur upon liquidation of the Fund; the participation units are not traded in the market and the sale and liquidity of such would depend on private deals/placements of such, in case the units are requested to be sold; investors of the Fund are exposed to a number of factors that influence the value of real estate investments, such as changes in property prices, location and quality, and to the financial capacity of tenants with respect to investments intended for rental; the investment is subject to the investee companies’ credit risk, which in adverse situations may not fulfill all its liabilities to third parties.

The Fund is subject to material risks which are set forth in detail in the Fund’s confidential private placement memorandum.

Such risks include, but are not limited to, those risks associated with investing in assets in Portugal and other selected countries, as well as investing in a concentrated portfolio of real estate and real estate-related assets.

The Fund has no operating history and is subject to limited regulatory oversight.

There is no assurance that the Fund will be able to meet its investment objective. The Fund may use leverage at the level of companies it invests into, which leverage presents opportunities for increasing the Fund’s returns, but also has the effect of potentially increasing losses as well.